The Demographics of Gig Work in Canada

Context

To get a better sense of the size and demographic composition of gig work in Canada, in July 2022 we commissioned Ipsos Reid (‘Ipsos’) to include a specific question on gig work in their eNation Canada Omnibus Survey, representing a total sample size of 3,000 adult Canadians. The sample was randomly selected from the Ipsos Online Panel and data were weighted to ensure the sample’s age and gender composition reflects that of the actual adult Canadian population according to Census data.

To estimate the extent to which Canadians engage in gig work, we added the following question to this online survey:

“In the past 12 months, have you earned income by providing services either full-time or part-time as an independent contractor or freelancer? This could include work conducted in person or through online platforms or apps (E.G. Upwork, Freelancer, Clickworker, PeoplePerHour, Uber, Skip The Dishes, Deliveroo, Handy, TaskRabbit and others). Sometimes this is referred to as 'gig work'.”

The results gathered allow us to draw some preliminary conclusions about the extent and demographic composition of gig work in Canada which is the focus of this blog post. Having directionally established the size of gig work in Canada through this first survey, we will collect detailed information regarding the nature of gig work in Canada through a second survey specifically tailored to gig workers. In an effort to characterize the specific circumstances of Canadian gig workers, this second survey will investigate the reasons why Canadians engage in gig work and their working conditions.

Key Takeaways

● Around 21% of Canada’s workforce engages in gig work.

● From a regional perspective, gig work appears to be more frequent in B.C., AB and

ON, whereas gig work is considerably below the national average in QC.

● Slightly more men than women are engaged in gig work.

● At 42%, members of Generation Z (‘Gen Z’) indicate the highest participation in gig

work, followed by Millenials at roughly 29%. Around 20% of members of ‘Gen X’ and

9% of the Boomer generation engaged in gig work.

● Household income appears to be less of a driving factor with regard to gig work as

the share of gig workers is relatively even across income groups.

● Participation in gig work also appears to be relatively even with respect to

educational attainment, with slightly higher representation of individuals with

university education, followed by.

Size of the Gig Workforce in Canada

As mentioned, the eNation Canada Omnibus comprised a sample size of 3,000 Canadians. Of the 3,000 people surveyed, a total of 654 (around 21%) answered ‘Yes’ to having undertaken gig work in the past 12 months. The data suggests that at 24%, the share of men among gig workers is slightly higher than the share of women at 18% (see Figure 1).

Figure 1: Gig work in Canada by Sex. Note: Of the total respondents 1,448 were male. Of these, a total of 354 (24%) answered with ‘Yes’ to having engaged in gig work in the past 12 months. Of the total respondents 1,514 were female. Of these, a total of 277 (18%) answered with ‘Yes’. A total of 38 respondents selected ‘Other/Prefer not to answer’. Of these a total of 14 (36%) answered ‘Yes’.

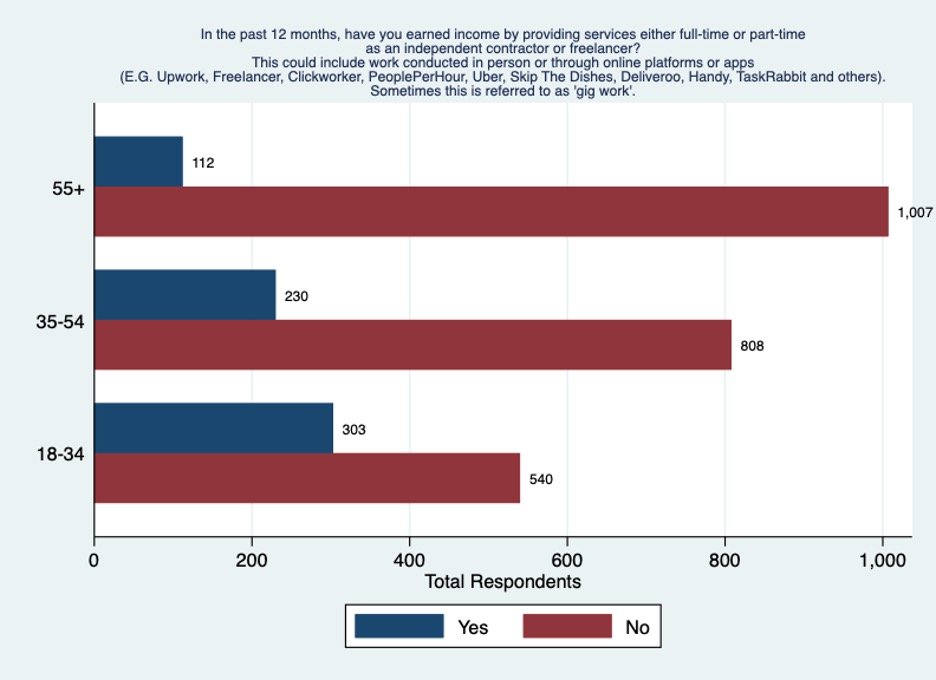

Gig Work by Age Cohorts

The survey distinguishes three main age cohorts. A total of 843 individuals in the youngest age cohort (ages 18 to 34) answered the survey. Of these, around 36%, or 303 individuals, answered ‘Yes’ to having undertaken gig work in the past 12 months - the highest portion of all age cohorts responding to the survey. Of the age cohort 35 to 54 years, 1,038 individuals participated in the survey. Of these, a total of 230 (22%) had engaged in gig work in the past 12 months. With a total number of respondents of 1,119, individuals aged 55 and higher comprised the largest group among survey respondents. Of these, only 10% had engaged in gig work in the past 12 months.

Figure 2: Gig work in Canada by age cohort.

Generational picture

In addition to age cohorts, the survey results also allow a breakdown by generational group. Table 1 depicts the common breakdown of generational groups by age and year of birth.

Table 1: Generational breakdown by age and year of birth.

Taking a generational view, of the total 3,000 survey respondents 825 were Millennials. As Figure 3 shows, around 29% of Millennials stated to have engaged in gig work over the past 12 months. A total of 840 survey respondents were members of Generation X; of these, around 20% stated to have participated in gig work in the past 12 months. At 365, members of Generation Z are the smallest group among survey respondents yet have the highest share of gig workers at 42%. Finally, the Boomer generation comprised 970 total survey respondents, of which roughly 9% stated to have participated in gig work in the past 12 months.

Overall, this suggests that members of the younger generations, i.e. Millennials and Gen Z, make up a higher share of gig workers in Canada.

Figure 3: Generational breakdown of gig work in Canada.

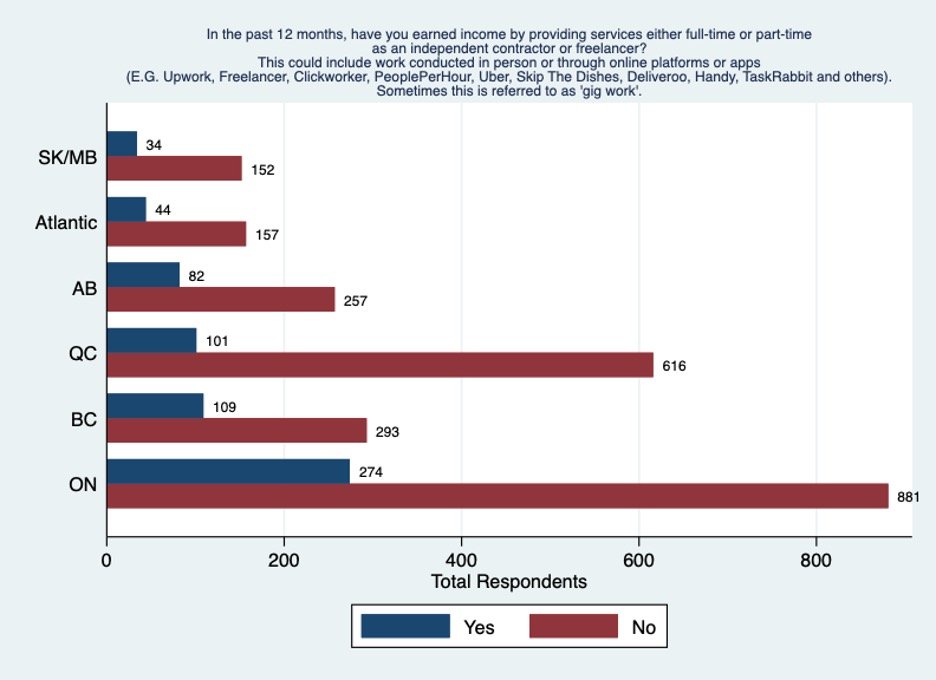

Gig work by Region

In total, the largest number of survey respondents (1,155) were from Ontario. Of these, almost 24% stated that they had engaged in gig work in the past 12 months, which is slightly above the national average of 21%. At 27%, the share of gig workers appears to be even higher in B.C., where 109 out of 402 responded with ‘Yes’ to having undertaken gig work. Numbers in Alberta appear to be similar to those in Ontario where around 24% of surveyed individuals indicated they had participated in gig work in the past 12 months. In Atlantic Canada, the share of gig workers is close to the national average at 22%, while it appears to be lower in Saskatchewan/Manitoba at 18%. Incidence of gig work seems to be lowest in Québec where 14% of all respondents stated to have undertaken gig work in the past 12 months.

Figure 4: Gig work by region in Canada.

Gig work by Educational Attainment

Based on the survey results, educational attainment does not appear to be a significant distinguishing factor with regard to gig work in Canada. The largest share of respondents, a total of 1,005 individuals, had a postsecondary education. Of these 202, or 20%, stated to have undertaken gig work in the past 12 months. An equal share had a high school degree or diploma. At 22% the share of gig workers is slightly higher among respondents with less than a high school degree or diploma. Among respondents who hold a university degree, 25% have engaged in gig work in the past 12 months.

Figure 5: Gig work by educational attainment.

Gig work and household income

Similar to educational attainment, the share of gig workers does not appear to differ significantly by household income. As is shown in Figure 6, the largest share of survey respondents (1,010) report a household income below $40,000. Of these a total of 218, or 22%, stated to have undertaken gig work in the past 12 months. At 23%, responses are fairly similar for households in the income categories $40,000 to less than $60,000, and for those earning between $60,000 and less than $10,000 per year. Of those respondents with an income above $100,000 per year, 21% indicated they have engaged in gig work in the past 12 months.

Figure 6: Gig work and household income.

Household Composition

Looking at household composition, the survey asked whether survey respondents have children under the age of 18 living within the household. Of the 3,000 respondents, 733 have at least one child under the age of 18 living in the household. Of these, 232 (around 32%) indicated to have undertaken gig work in the past 12 months. Of the 2,267 respondents without children under the age of 18 at home, 413 (roughly 18%) stated to have been engaged in gig work, a number slightly below the national average of 21%. This suggests that gig workers are more likely to have at least one child under the age of 18 at home.

Figure 7: Household composition and gig work.

Next Steps

Results gathered to date have allowed us to draw some preliminary conclusions about the extent and demographic composition of gig work in Canada. Notably the data showing some concentrations both regionally, by gender and by income, as well as some stratification by age cohort. Based on this initial survey, early results also seem to show that household income and educational attainment have less effect on gig work participation than originally anticipated.

Having directionally established the size of gig work in Canada through this first general survey, we next will collect detailed information regarding the nature of gig work in Canada through a second survey specifically tailored to gig workers. This second survey, to be delivered in early Fall 2022, will investigate and explore the reasons why Canadians engage in gig work and their working conditions.